Tips for Buying a New Home

Buying a new home isn’t easy, but it shouldn’t be that difficult if you know how to go about it. Here, we present tips on how to find your perfect home. We take into account things such as down payment and mortgage equity.

1) Compare

Check the actual selling prices of comparable homes that you can find in your dream area. What is your ideal size? How big do you want your property to be? How many rooms do you expect your house to have? Also, consider that down payments are usually 20% of the market value of the actual price.

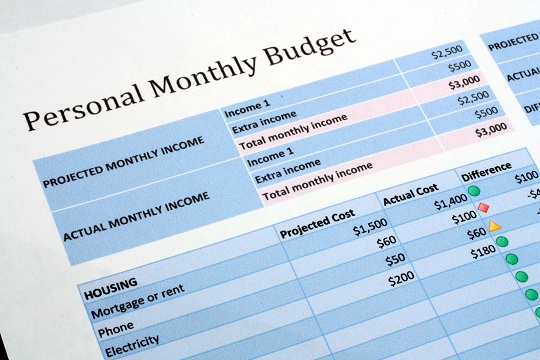

2) See What You can Afford

Banks have mortgage calculators with which you can check how much mortgage you actually have to pay. Then, you can check your budget to see if it will actually fit. This is crucial, because you can’t go rushing into buying a house that you can’t actually afford.

3) Find Out your Total Housing Cost

This includes homeowner’s dues, taxes, and insurance. You have to factor these in along with your down payment and your mortgage. These costs do add up, so make sure to consult a financial consultant before buying or renting property.

4) Closing Costs

These include title and settlement fees, taxes, and prepaid items such as homeowner’s dues. Again, you have to factor these into your final calculations of the total cost of your new home.

5) Talk to Experts

There is nothing like talking to reputable real estate agents in your area regarding your probable purchase. They know more than you do, so it is best to leave it in their hands rather than yours. Consult them for your every need. Do not hesitate to ask questions, because it helps.

Ready for More Help?

Contact TalkLocal today. We will connect you with up to three real estate accountants near you.